4 Jul 2022

How a FLISP subsidy can help with buying your first home

What is a FLISP subsidy?

Financial Linked Individual Subsidy Programme(FLISP) enables first-time home-ownership for households classified within the ‘affordable or gap’ market.

Households in this market generally earn an income that is too low to qualify for home loans and too high to qualify for ‘free’ government housing subsidies. This is where FLISP can make a difference.

Who qualifies for a FLISP subsidy?

Households with an income between R3 501 to R22 000 may qualify for the FLISP subsidy if they meet all the criteria:

- First time home buyer.

- South Africa Citizen with a valid identity document or permanent resident with a valid permit.

- Over the age of 18 or legally married or legally divorced and of sound mind.

- Married or cohabiting or are single with financial dependents.

- Must never have benefitted from any Government Housing Subsidy Scheme before.

Use the FLISP subsidy amount calculator to calculate the approximate subsidy you will be eligible for - simply select your income bracket and complete the information required.

Can you buy a house with a FLISP subsidy?

Yes, your subsidy amount will be based on your income range, and you must meet the qualifying criteria.

We recommend that you apply for FLISP immediately after your home loan approval to avoid delays with your bond registration process, especially if you intend to use the subsidy to pay for your deposit, transfer or bond registration costs.

You may also apply for FLISP after your bond is registered; however, the application must be sent within 3 months. Please note that this varies by province.

Keep in mind that the FLISP subsidy is only valid for the purchase of residential properties in areas where the transfer of ownership and registration of the bond are completely recordable at the Deeds Office.

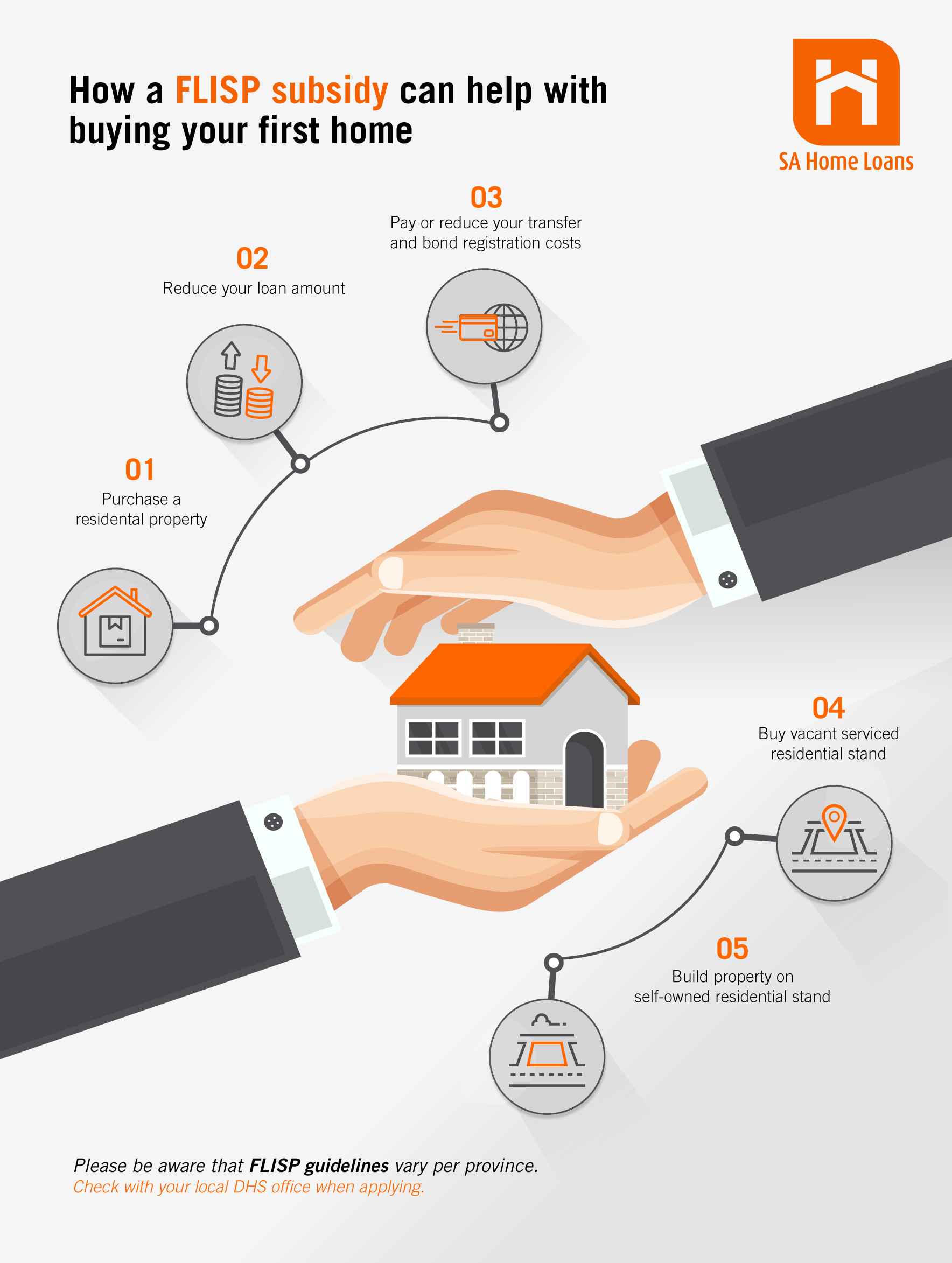

How FLISP can help with purchasing your home

There are a few ways FLISP can help you purchase a house. you can use the subsidy to:

- Purchase a residential property;

- Reduce your loan amount;

- Pay or reduce your transfer and bond registration costs;

- Buy vacant serviced residential stand or;

- Build property on self-owned residential stand;

Amendments to FLISP from 1 April 2022

- Includes cover for related attorney costs and fees

- Retrospective FLISP subsidies for current homeowners will soon also be available. This is dependent on Provincial guidelines, so we advise that you speak to a consultant at your local DHS office.

First-time buyers can qualify for a FLISP subsidy if they have financial assistance to buy a property in the form of:

- the beneficiary’s pension/provident fund loan,

- a co-operative or community-based savings scheme, i.e. stokvel,

- the Government Employees Housing Scheme

- any other Employer-Assisted Housing Scheme,

- an unsecured loan (non-mortgage home loan). For example, a personal loan with no asset security for the business.

- an Instalment Sale Agreement or Rent-to-own Agreement.

How can SA Home Loans assist with your FLISP application?

For FLISP subsidy consideration,applicants must produce a signed Letter of Acceptance indicating from a South African accredited financial institution,such as SA Home Loans.

We are a specialist mortgage provider with experience in providing home loans suited to each applicant. We will give you our best possible rate and also help work out how to structure your mortgage to gain maximum equity from your property.

SA Home Loans assess each application according to our credit and affordability standards and the National Credit Regulator’s lending criteria, which form a part of the FLISP application process.

After finding a home that warms your heart, contact our team to get your home loan application started by calling 0860 2 4 6 8 10, emailing [email protected] or visiting the contact page on our website.

Visit our 2022 FLISP guide to learn more about this housing subsidy.